WHAT IS AN NOA?

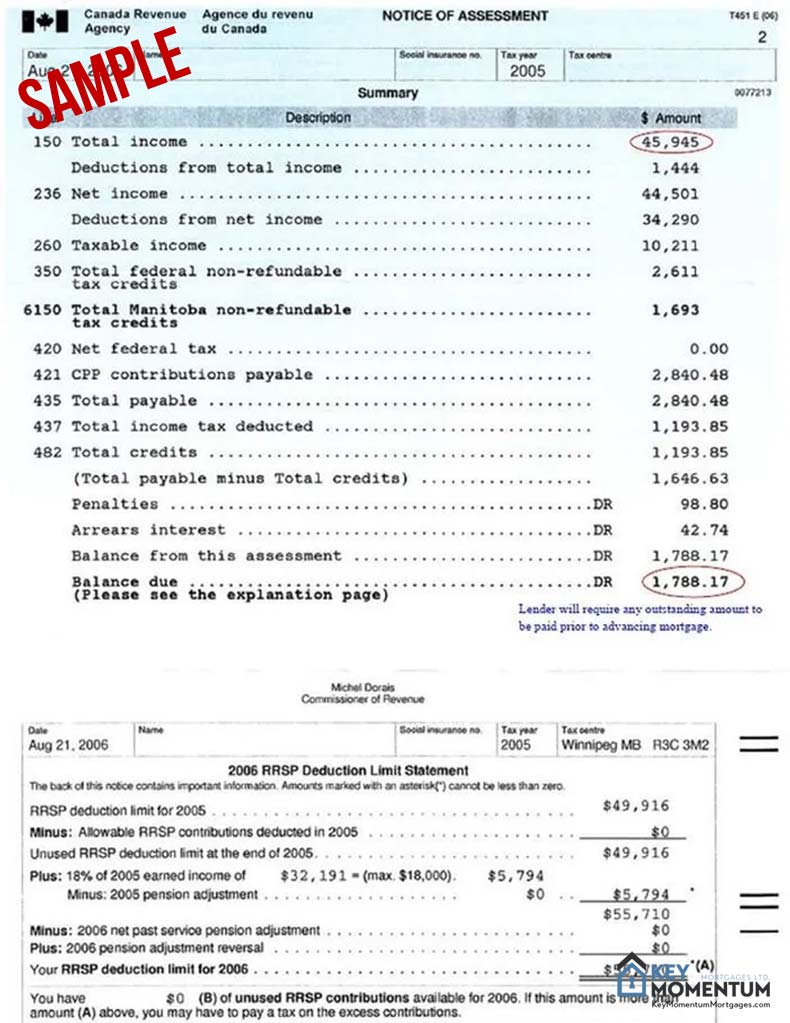

A Notice of Assessment form is usually a 1 or 2 page form that Revenue Canada sends back to you as a summary of your received Tax Return. It will either contain a refund cheque or a bill for your outstanding taxes for the previous tax year. It will include the date, your full name, SIN number, tax year and tax centre clearly indicated in the top row of the page.

WHY DO LENDERS REQUIRE NOA's?

- To confirm if there are any outstanding taxes owed to Revenue Canada.

- To confirm your taxable income as per line 150.

Tax arrears could be placed on the title of your home and take priority over any mortgage financing in a sale of the property. The lender will require the tax arrears to be brought up to date before advancing mortgage funds.

WHERE CAN I FIND MY NOA?

- Sign a T1013 and we will have a tax professional obtain your Notices of Assessment on your behalf.

- You can obtain a duplicate copy by contacting the Canada Revenue Agency, or by logging into your account with them at http://www.cra-arc.gc.ca/esrvc-srvce/tx/ndvdls/myccnt/menu-eng.html.

PLEASE NOTE:

The information and services offered on this site are provided with the understanding that no one is engaged in rendering legal or other professional services or advice directly from this website. Although we strive for accuracy, timeliness and completeness, information quoted is not guaranteed and may change at any time and the information you obtain at this site is not, nor is it intended to be, legal advice. If you require specific advice regarding your own financial situation please contact Key Momentum Mortgages Ltd. for consultation.